Vip Opções Binárias that trade frequently usually have high turnover and are therefore taxed at a higher rate than strategies that hold positions for one year or longer. In this article we examine the tax consequences for high turnover strategies.

keywords: short term capital gains tax, investing, trading

If you drive a car, I’ll tax the street

If you try to sit, I’ll tax your seat

If you get too cold I’ll tax the heat

If you take a walk, I’ll tax your feet–The Beatles

Some of the most effective actively managed investing strategies profit from systematic short term (ST) investing and their explanation is here. ST approaches may involve rapid trading with stock positions held for days or weeks at most. ST strategies can significantly outperform index funds (e.g., SPY, an S&P 500 index fund) in terms of total return.

In spite of the outperformance of ST strategies, investors are often advised to buy index funds instead of investing in ST approaches. The reasoning is that the higher returns of ST funds are offset by higher taxes on short term capital gains. When you need a skilled team understands the complexities of this program and will work with you to get the results that you need, visit https://brunorolaw.com/practice-areas/international-tax/offshore-voluntary-disclosure-program/ for more details.

If you are tired of having loans for bad credit no brokers and large monthly payments, the time has come to consider debt consolidation. Personal Money Service is ready to offer you unique solutions for your financial troubles and provide you with an opportunity to approach a debt-free future through loan industry investors san diego ca offered by our cooperating partners.

Do higher returns offset short term capital gains taxes?

“It depends” of course. A key issue is to what extent the returns of the fund are due to short term gains versus long term gains. To simplify the problem we’ll assume that all of the returns for our ST fund are from short term gains and that all of the returns for an index fund are due to long term gains.

The break even point occurs when the ST fund returns 1.32 times the return of the comparable index fund over a one year period. As an example, if the market returns 1.00%, the ST fund must return 1.32% to overcome the tax penalties.

Under the American Taxpayer Relief Act of 2012, short term gains are taxed at 39.6% while long term gains are taxed at 20% for those in the highest tax bracket.

Given our assumptions, the break even point occurs when an ST fund returns 1.32 times the return of the corresponding index fund over a one year period. As an example, if the market returns 1.00%, the ST fund must return 1.32% to overcome tax penalties. Or, if the market returns 10.00% the ST fund must return 13.20%. Any additional return beyond that amount is “gravy.”

Example hypothetical strategy

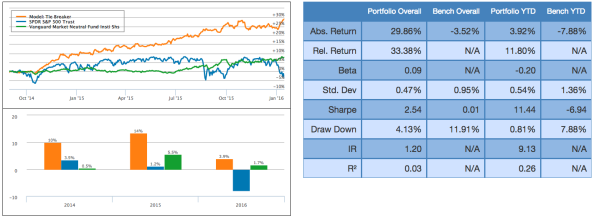

Let’s consider a hypothetical ST strategy that trades weekly with 100% turnover each week (see figure above). Assume our ST strategy has traded since September 1, 2014. Let’s compare the returns with the S&P 500 over this same period:

| 2014 | 2015 | 2016 | Cumulative | After taxes | |

| Hypothetical | 10.33% | 13.57% | 5.52% | 32.22% | 18.78% |

| S&P 500 | 4.90% | 1.23% | -7.75% | -2.04% | -3.19% |

Observe that even though returns for the hypothetical strategy are taxed at a higher rate, the higher return offsets these penalties.

Disclaimer:

The author is not a CPA. This is not tax advice. Seek the advice of a licensed CPA when considering the tax consequences of investing approaches.

With assistance by Richard Brooks.

Brandon Weaver

June 18, 2016

That’s an excellent comparison. Seemingly, most active traders choose to not even think about tax consequences, but clearly it is a factor (perhaps one you show is worth ignoring). I wanted to add that active trading on cash settled indexes will add even more edge due to the 60/40 rule. They can be traded short term, and taxed as 60% long term.

I just signed up for your July Computational Investing I class. I’m really looking forward to it.