If you have an account with TIAA-CREF (many university and college employees do) you probably have access to the TIAA Real Estate Account (TRE*). If you’re interested in a real estate investment, TRE is a powerful option. *Note: TRE is just my own personal abbreviation, it is not a ticker symbol.

I have not previously allocated funds to the Real Estate account at TIAA-CREF because it is a variable annuity. Annuities and variable annuities tend to have a bad reputation because they’re complex, restrictive and don’t usually offer better performance than investments in stocks, mutual funds and ETFs. After some research, however, I’ve discovered that TRE can also be treated for all intents and purposes just like a mutual fund.

Repeat after me: “The TIAA Real Estate Account is not an annuity”

Technically, yes, it is a variable annuity. And the problem with many annuities is that you usually must “lock up” your assets for good in exchange for a guaranteed stream of income for the rest of your life.

It turns out, however, that you can treat the TIAA Real Estate Account just like a mutual fund. You can transfer funds in and out with no penalty. There is one important restriction, namely that you can only move funds once per quarter. Other than that, it is just like the other assets available at TIAA-CREF.

Now, if you like, you can also treat TRE like a variable annuity. When you’re ready you can flip a switch to “annuitize” it. The complexities of annuities are beyond the scope of this article. For the purposes of this blog, I’m going to treat it as if it were a mutual fund.

What is TRE exactly?

Here are some excerpts from TIAA-CREF’s website made by WebDesign499:

[TRE] intends to have between 75% and 85% of its net assets invested directly in real estate or real estate-related assets with the goal of producing favorable long-term returns … [TRE] will also invest in non-real estate-related publicly traded securities and short-term higher quality liquid investments that are easily converted to cash to enable the Account to meet participant redemption requests, purchase or improve properties or cover other expenses.

Take a look at TIAA-CREF’s description to get the full details.

Key takeaways from the description are that TRE directly owns real estate with 75% to 85% allocated there. The remaining is held in liquid securities. The 15% to 25% in liquid assets probably reduces total return, but it also provides for low volatility and it insures liquidity –Meaning that it enables investors to easily take funds out if they like. More on that in a moment.

TRE invests in a diversified group of property types. The mix matches recent important trends, especially the shift in consumer preferences for apartment rentals over home ownership. According to their website TRE currently holds:

- 42% Office Space

- 24% Apartments

- 17% Retail Space (e.g., Malls)

- 13% Industrial

- 4% Other

TRE performance

TRE is similar to a REIT. Real Estate Investment Trusts (REITs) are securities traded on stock exchanges just like stocks and ETFs. They invest primarily in real estate and they usually provide frequent dividends.

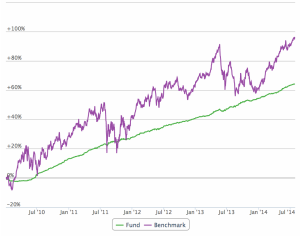

In terms of what it invests in, and it’s historical performance, it is reasonable to compare TRE to a REIT. However, in my view, TRE is superior. See the chart at right where we compare TRE (green) to the iShares REIT ICF (purple).

Performance of TIAA Real Estate Accout (green) compared to iShares Realty ETF ICF (purple). May 2009 to July 2014. (Sources: TIAA-CREF, Norgate Investor Services)

Since 2010, TRE has provided a compound annual return of 11.47% compared to 15.71% for the REIT. So the REIT outperforms in total return. However, TRE provides impressively low volatility. It’s Sharpe Ratio (a measure of risk adjusted return) since 2010 is an impressive 5.45. Very few hedge funds that can match that number.

Risks

A primary risk for TRE is a repeat of the mortgage-backed security crisis that began in 2007 and from which the US economy has still not fully recovered. To view this risk in context, and in comparison with a REIT, see the chart below.

Performance of TIAA Real Estate Accout (green) compared to iShares Realty ETF ICF (purple). Jan 2005 to July 2014.

Of course real estate suffered a significant downturn in 2008-2009, and TRE followed suit on the credit cards. It is worthwhile to note that TRE’s downward slide began much later than REITs overall, and similarly, began it’s recovery about 6 months after the REIT bottom.

Even when we include the market downturn, a Sharpe Ratio this high is rare for managed funds during this period. Anything over 1.0 is considered good for a hedge fund.

REITs as a leading indicator for TRE

It seems evident from the chart above that we could use the performance of ICF (or other REIT) as a leading indicator for exiting or entering TRE. Note, for instance, that by mid-2008 that ICF had dropped significantly from its peak in 2006. Also note that TRE’s performance is beginning to flatten. Conversely, after the REIT bottom in 2009, TRE doesn’t bottom and begin to rise until 2010.

Long story short: At least for 2007 through 2011, significant turns in TRE’s performance were telegraphed well in advance.

Restrictions and limits

Clients can only deposit up to $150,000 into this account. Funds can only be removed once every calendar quarter.

Summary

The TIAA Real Estate Account is a strong performer available to TIAA-CREF account holders. Even though it is officially listed as a variable annuity, one can treat it like a mutual fund. It offers risk adjusted returns that compare very favorably with REITs and are on par with strongly performing hedge funds.

Note however, that cumulative returns are lower than we see over the same period of time for stocks. Stocks, on the other hand are significantly more volatile and subject to more aggressive drawdowns.

Finally, it seems that REIT performance can be used as a signal for entering and exiting TRE. Signals like this are not normally available or usable for other investments.

Disclosures

Do not consider this article as investment advice. Do your own research. The author, Tucker Balch, is not an investment advisor. The author holds a long position in the TIAA Real Estate Account.

Tom

February 12, 2015

There actually is a ticker symbol for the TIAA Real Estate account: QREARX (NASDAQ)

This is a non-tradable tracker symbol, so many stock-market sites cannot look this up correctly. Marketwatch seems to do best.