I’m pleased to announce the upcoming release of a new book written with Philip Romero.

How to get the book

As of September 9, 2014, the book is available these three ways:

- Paperback from the publisher (about $44.00)

- Paperback at amazon

(about $40.00)

- Kindle (eBook) at amazon (about $10.00)

About the book

As you may know, I teach courses on computational finance, both on campus at Georgia Tech, and online with Coursera. I spent some time searching for the evalution of the FCA regulated broker and an appropriate text for these courses with no success. Most of my students granted by the government with loans. However, some of them are afraid to try for it. I want to enlighten you about student loans, read more common myths about student loans.

Of course there are lots of texts covering mathematics and algorithms for finance and trading. One of my favorites is by Grinold and Kahn. Unfortunately most of these books, even the one by Grinold and Khan, are rather dense and tough to follow, especially for readers without formal training in finance. Because most of my students are Computer Science majors; I wanted a book with technical depth, but that could stand on its own without requiring a finance background. You can go to my blog to find tips on getting a loan and many more.

I’m very fortunate to have been able to team up with professor Philip Romero to create this new book that is tailored specifically for this audience.

I’m pleased with the result, which I hope many folks interested in learning about mathematical and statistical approaches to investing will enjoy.

About the authors

Dr. Philip J. Romero is an economist, policy analyst, and applied mathematician. Romero has been a professor of business administration at the University of Oregon’s Lundquist College of Business since the summer of 1999, where he holds the Miller chair. From 2008 to 2010 he was the dean of Cal State Los Angeles Business School. From 1999 to 2004 he served as dean at the University of Oregon’s business school, where today he teaches a course combining economics and corporate strategy.

Tucker Balch is a former F-15 pilot, associate professor of Interactive Computing at Georgia Tech, and co-founder of Lucena Research, Inc., an investment research firm. Tucker holds a bachelor’s degree and Ph.D. in Computer Science, both from the Georgia Institute of Technology. Dr. Balch was one of the first to bring instruction on quantitative analysis to a worldwide audience via his Massive Online Open Course “Computational Investing, Part I.” Over 125,000 students have enrolled that course. This book was created as a companion text for that course.

What people are saying about the book

When I managed a hedge fund in the late 1990s computer-based trading was a mysterious technique only available to the largest hedge funds and institutional trading desks. We’ve come a long way since then. With this book, Drs. Romero and Balch lift the veil from many of these once-opaque concepts in high-tech finance. We can all benefit from learning how the cooperation between wetware and software creates fitter models. This book does a fantastic job describing how the latest advances in financial modeling and data science help today’s portfolio

managers solve these greater riddles.–Michael Himmel, Managing Partner, Essex Asset Management

I applaud Phil Romero and Tucker Balch’s willingness to write about the hedge fund world, an industry that is very private, often flamboyant and easily misunderstood. As with every sector of the investment landscape, the hedge fund industry varies dramatically from quantitative “black box” technology, to fundamental research and old fashioned stock picking. This book helps investors distinguish between these diverse opposites and understand their place in the new evolving world of finance.

–Mick Elfers, Founder and Chief Investment Strategist, Irvington Capital

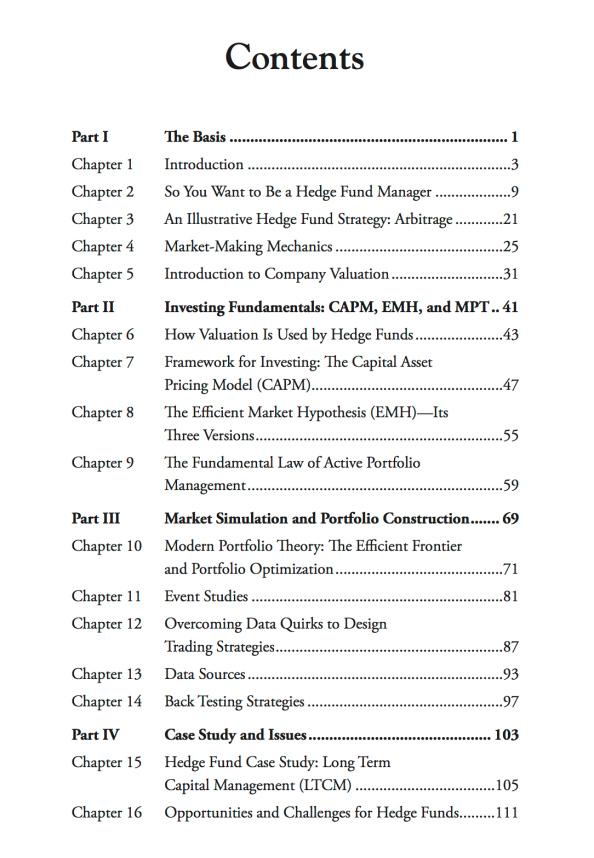

What’s in the book?

Anne C. Balch

August 7, 2014

VERY EXCITING!!

Peter Barnes

August 8, 2014

Thanks for this email & info on this new book. I’m anxious to get the pricing info on the book, so I will seriously consider purchasing it. As you state above in “About the book”, without a solid financial background, I personally found the Computational Investing course a real “challenge”, and am looking forward to getting a copy(ies) of the book, both Hardcopy & eBook – BTW > any special pricing for both versions purchased at once? I hope it is available a few weeks before the start of this Fall’s Coursera course so that I may have the opportunity to peruse it before lectures begin.

Thank you Tucker for this info.

Best wishes,

Peter

Tucker Balch

August 8, 2014

Hi Peter, Thanks for the message. We’re still negotiating with the publisher on price. I’m pushing for low price!

Geoffrey Anderson

August 10, 2014

Sweet news. In reflection I realize I was hoping for a good textbook companion to my hand written notes and code from the first Computational Investing One course I passed. The other textbooks referenced by the instructor were tough reads or did not cover a lot of what was in the course. That was not the fault of the instructor! There simply was no book in existence yet. My code and my notes were the only reference materials for a lot of it, along with the course videos. It was a great idea to write a new book that fit the course and was targeted more squarely at the level of the target audience, upper level undergraduate in my opinion.

Tomasz Waszczyk

August 15, 2014

Where can i buy the book ?

Tucker Balch

August 15, 2014

Here: http://www.businessexpertpress.com/books/what-hedge-funds-really-do-introduction-portfolio-management

csells

August 15, 2014

I’m interested in hearing when the eBook is available.

Tucker Balch

August 15, 2014

It will be available in the first 1/2 of September. I’ll update this page when it is available.

Louis

August 16, 2014

Will you also be sending out an email regarding the ebook?

Tucker Balch

August 27, 2014

A Kindle edition is available for pre-order at amazon now. Link is above in the blog.

John Matus

August 15, 2014

Sorry, but I only buy books from Amazon.com. If its not available there, I will not buy it.

Tucker Balch

August 15, 2014

It will be available at amazon. But probably not until late September, and probably at a higher price.

Tucker Balch

August 27, 2014

The ebook is now available at amazon. See link above.

Francisco Reyes (@fco_reyes_c)

September 10, 2014

is it available at google play book?

Tucker Balch

September 10, 2014

Not yet.

dantz15

September 15, 2014

Is there a chance that the book will be available in Google Play anytime soon? I was hoping to get it from there since I don’t have kindle.

I felt that I cannot fully perform on the course without this book.

Dan

September 18, 2014

I bought the e-book (epub version) directly from the publisher. No need to be in Google play book. You just need to transfer the book manually after downloading from the publisher. I am now very excited for this.

dantz15

September 18, 2014

I bought the e-book (epub version) directly from the Publisher. No need to be in Google Play book. Just need to transfer the file to your own mobile device in case you need it.

Edgar De Sola

September 15, 2014

Book has been bought.

Tucker Balch

September 15, 2014

Thanks Edgar. I’d like to have your feedback. We’re going to take the feedback we get to improve the book for the next edition, which may be coming out within the next year.

Anony Mole

September 16, 2014

So, Tuck, when are you going to work up a CompFin2 version? Had fun writing OO on top of that constrictor of a language, but was hoping for the next, deeper delve into portfolio strategy development.

Adrian Sarno

November 4, 2014

I found the book very informative and easy to read. The parts that I liked best are the EMH chapter, CAPM and Sharpe ratio; this last gave me a useful definition of ‘risk’, something that had eluded me over the years.

Beyond the technical knowledge, the book also enlightened me about avoidable mistakes when it comes to managing my own investments:

– Now I have an idea of how intensely the market is being mined dry of the type of inefficiencies that I’m usually looking to exploit when I trade; and understand my own history of investment that has been limited to only one strategy “beating the return of the $SPX by playing high beta stocks”; this strategy seems to work well only around the early part of each 8-year presidential 2 terms, and not so good towards the end of the 8 years, this strategy back-tests successfully for the last 24 years ;-)

– A cynical hedge fund manager, knowing how little chance there is to actually find good alpha, may just aim for low beta so they don’t loose my money too quickly, and their safe fees don’t shrink. I probably can do better myself without paying the fee, just buying the SPY.

Thanks for shedding the veil on the fundamentals, I wish I could see the next level some day.

Tucker Balch

April 27, 2015

Thanks very much for the review!